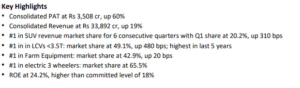

Mahindra and Mahindra, a major player in the automotive industry, has reported impressive financial results for the quarter ended June 2023. The company’s standalone net profit surged by 98% to reach Rs 2,774 crore, compared to Rs 1,404 crore in the same period the previous year. This significant increase in net profit indicates a strong performance and growth for the company.

Moreover, the revenue from operations during the quarter saw a substantial rise of 22% year-on-year (YoY) to Rs 24,056 crore. The increase in revenue points towards increased demand for Mahindra and Mahindra’s products and successful business operations during the mentioned quarter.

Additionally, Mahindra and Mahindra made a strategic investment by acquiring a 3.53% stake in private sector lender RBL Bank for Rs 417 crore. The company clarified that this investment was made with a long-term view, spanning 7-8 years. Such a move suggests that Mahindra and Mahindra is considering RBL Bank as a promising investment opportunity and expects it to yield positive returns over the long term.

In addition to its strong financial results, Mahindra and Mahindra has reaffirmed its commitment to the electric vehicle (EV) segment. The company stated that its plans to launch a new range of electric SUVs were on track. Currently, Mahindra has one mainstream electric offering in its four-wheeler portfolio, the XUV400, and deliveries for this model began in March.

The company’s Chief Executive Officer, Anish Shah, clarified that they were not seeking additional funding in the EV space. This statement comes right after Mahindra and Mahindra secured Singapore’s Temasek as an investor for its EV unit, Mahindra Electric Automobile. The investment from Temasek likely signals confidence in Mahindra’s electric vehicle initiatives and future prospects in the EV market.

With a focus on expanding its EV lineup and securing investments for its EV unit, Mahindra and Mahindra is positioning itself to be a significant player in the electric vehicle industry. As the automotive sector continues to shift towards sustainable mobility solutions, the company’s efforts in the electric vehicle space could help drive its growth and competitiveness in the market.

Overall, these financial results demonstrate Mahindra and Mahindra’s strong performance in the automotive sector and its commitment to making strategic investments to enhance its growth prospects. The company’s positive outlook on its investment in RBL Bank further reflects its confidence in the potential of the financial sector.